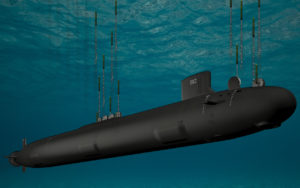

The Congressional Budget Office’s (CBO) annual analysis of the Navy’s fiscal year shipbuilding plan said the DDG(X) next-generation guided-missile destroyer could cost up to $3.4 billion each and the SSN(X) next-generation attack submarine could cost up to $7.2 billion each. The report underscored the Navy’s FY 2023 long-range shipbuilding plan said production of the DDG(X) is expected to start in 2030, two years later than the December 2020 shipbuilding plan and five years later than the fiscal year 2020 plan.…

By

By