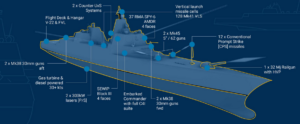

A new Congressional Budget Office (CBO) report comparing various future fleet size costs said moving to a 355-ship Navy in 10-20 years is doable but will cost hundreds of billions more over 30 years.The Navy currently operates 280 ships.The CBO report looked at four options: getting to 355 ships quickly by building more ships for the next 20 years; building more ships and extending the service life of some ships (SLEPs); maintaining a size comparable to today’s 280 ships; and…

By

By