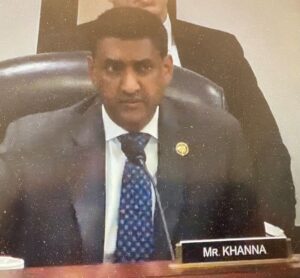

Reps. Mike Gallagher (R-Wis.), the chairman of the House Armed Services Committee's (HASC) cyber, information technologies and innovation (CITI) panel, and Rep. Ro Khanna (D-Calif.), the HASC CITI panel's ranking member, called out corporate refusal to testify at a Sept. 20 hearing focused on what DoD needs to do "to turbocharge our innovation enterprise" and "defibrillate a sclerotic defense industrial base," in Gallagher's words. Gallagher said that he is inviting Deputy Defense Secretary Kathleen Hicks to testify at the next…