The Navy this week submitted the latest 30-year shipbuilding plan to Congress, offering a primary profile with significant cost and size growth and an alternative profile constrained by lower budget amounts.

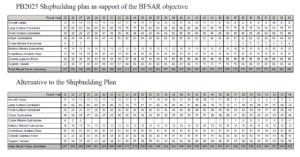

The main option the Navy offers follows the 2023 Battle Force Ship Assessment and Requirement (BFSAR) but it requires a consistently higher funding level and seeks a larger fleet. The Navy calls this the official 2025 shipbuilding plan.

Several media outlets first broke news of the plan on Tuesday

, but it has not yet been published on the Navy’s website as of publication time.

This “assumes industry produces future ships on-time and within budget. The high range represents an average of $2.7B per year in real growth beyond the FYDP in FY2024 constant dollars. The increased procurement level, informed by industrial base capacity and on-time and on-budget performance, achieves 330 manned battle force ships in the mid-2030s, and ultimately achieves 377 manned battle force ships in FY2045,” the plan reads.

It said this profile also assumes industry eliminates excess construction backlogs and produces future ships on time and on budget as well as future capacities.

“This profile reflects growth matched to planned, but not yet achieved, industrial capacity and a larger force requiring additional resources beyond the FYDP.”

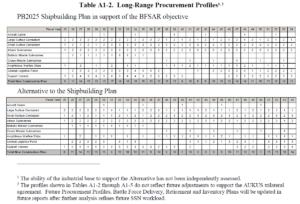

However, the resource-constrained alternative assumes no real topline growth over inflation while assuming industry still eliminates excess construction backlog and produces ships on time and within budget. After the FYDP, the alternative is limited to 2.1 percent shipbuilding account inflation growth.

This latest shipbuilding plan breaks the pattern of the Navy previously offering three profile options for two years in a row, a style that consistently annoyed lawmakers in the armed services committees.

In the FY 2024 plan, the Navy assumed the same 2.1 percent shipbuilding budget growth for inflation in the two profiles without a significant expansion. That year’s larger profile assumed an average of $4.4 billion in real growth (Defense Daily, April 18, 2023).

Both profiles under the FY ‘25 plan procure two attack submarines (SSNs) per year through the 2030s to support the National Defense Strategy and the AUKUS agreement as well as sustain the congressionally-mandated floor of 31 amphibious ships.

Notably, the Navy said given the priority on the Columbia-class ballistic missile submarines (SSBNs), SSNs and amphibious ships, the resource-constrained profile “forces procurement gaps and/or inconsistent procurement profiles in other ships classes.”

The alternative profile specifically has lower procurement numbers in small and large surface combatants and combat logistics ships.

The Navy underscored both profiles comply with the FY 2024 defense authorization act that mandated the 31 amphibious ship minimum, so it is examining how to execute life extensions and maintenance to keep those numbers.

“Service life extension planning and investment will be addressed in future budget submissions.”

The current plan also includes extensions to several landing helicopter dock ships (LHDs) beyond their 40-year expected service lives as well as an increase in amphibious assault ship (LHA) procurements to 3.5-year centers “to ensure proper planning for the correct maintenance tracking actions and overall force size in support to the Marine Corps.”

In 2022, Kari Wilkinson, executive vice president at HII [HII] and president of Ingalls Shipbuilding, told reporters ideal centers, or time between procurements, for LHAs is about three to four years apart while the Navy has been ordering them closer to five years apart (Defense Daily, May 18, 2022).

Under the primary growth plan, the Navy would seek to procure two large surface combatants annually into the late 2030s, when new ships are procured in a 1-2-1-2 saw tooth pattern; small surface combatants including the Constellation-class frigate grow from the current sawtooth pattern to three ships procured per year starting in the 2030s; attack submarines maintained at two per year; and amphibious ship procurement growing to one or two almost every year starting in the late 2030s.

In contrast, the constrained alternative moves large surface combatants to one ship per year for most years starting in the 2030s, small surface combatants boosted from the 1-2-1-2 sawtooth profile to a 2-3-2-3 profile; SSNs lowering to one per year a few times in the 2040s and 2050s; and amphibious ships with similar numbers but only procuring two ships in a year twice between now and 2054.

When comparing fleet sizes over the following 30 years, the growth profile sees the Navy reaching over 350 crewed ships by the late 2030s and reaching 387 ships by 2054. At that point, the Navy would have nine aircraft carriers, 77 large surface combatants, 68 small surface combatants, 66 SSNs, four cruise missile submarines, 12 SSBNs, 31 amphibious ships, 56 combat logistics force ships, and 64 support vessels.

The service also estimates it could achieve a further 89 to 143 unmanned platforms by FY 2045, but said more analysis is needed to determine specific future unmanned vehicle objectives.

The alternative budget-constrained profile would peak the Navy’s size at 348 ships in 2042 and 342 ships in 2054, but with significantly lower surface combatants, logistics and support vessels. In 2054 the Navy would have nine carriers, 70 large surface combatants, 50 small surface combatants, 64 SSNs, four cruise missile submarines, 12 SSBNs, 31 amphibious ships, 43 combat logistics ships and 59 support vessels.

The Navy said the modest increase in battle force options beyond the FYDP is due to the Medium Landing Ship (LSM) and Next Generation Logistics Ship delivering the Light Replenishment Oiler (T-AOL).

The plan noted the Medium Landing Ship (LSM) for the Marine Corps is grouped under support vessels while the T-AOL is grouped with combat logistics forces.