Defense Daily

-

Monday, February 2, 2026

- Defense Watch: DIB Days, DoD Biz Portal, Indian V-Bats, Drone Charging

- L3Harris Nabs Marine Corps Precision Attack Strike Munition Contract

- Pentagon Set For Temporary Weekend Shutdown, As Senate Votes On Final Spending Deal

- Boeing Awarded Up To $2.8 Billion For F-15K Upgrades

- Army Awards $1 Billion To RTX For LTAMDS Radar Production

- Second Ford-Class Carrier Out For Initial Sea Trials

- Construction Of Anduril’s Arsenal-1 Facilities Underway; Production Of Fury Ahead

- Varda Space Capsule Launched In November Successfully Returns To Earth

-

Monday, February 2, 2026

- Defense Watch: DIB Days, DoD Biz Portal, Indian V-Bats, Drone Charging

- L3Harris Nabs Marine Corps Precision Attack Strike Munition Contract

- Pentagon Set For Temporary Weekend Shutdown, As Senate Votes On Final Spending Deal

- Boeing Awarded Up To $2.8 Billion For F-15K Upgrades

- Army Awards $1 Billion To RTX For LTAMDS Radar Production

- Second Ford-Class Carrier Out For Initial Sea Trials

- Construction Of Anduril’s Arsenal-1 Facilities Underway; Production Of Fury Ahead

- Varda Space Capsule Launched In November Successfully Returns To Earth

-

Navy/USMC

Navy/USMCL3Harris Nabs Marine Corps Precision Attack Strike Munition Contract

Naval Air Systems Command (NAVAIR) on Friday announced it awarded L3Harris Technologies [LHX] an 86.2 million contract for its Red Wolf launched effects vehicles for the Marine Corps’ Precision Attack […]

Tagged in: -

Navy/USMC

Navy/USMCSecond Ford-Class Carrier Out For Initial Sea Trials

The Navy’s second Ford-class aircraft carrier, the future USS John F. Kennedy (CVN-79), sailed out to sea for the first time on Jan. 28 for its initial set of sea […]

Tagged in: -

International

InternationalBoeing Awarded Up To $2.8 Billion For F-15K Upgrades

The U.S. Air Force has awarded Boeing [BA] a $2.8 billion contract to upgrade South Korea’s fleet of F-15K Slam Eagle fighters, the Defense Department said on Friday. The contract […]

-

Congress

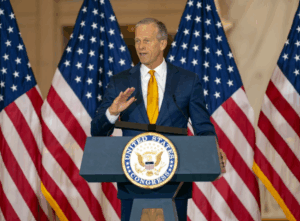

CongressPentagon Set For Temporary Weekend Shutdown, As Senate Votes On Final Spending Deal

While the Senate will vote Friday night on a spending deal that includes final fiscal year 2026 defense appropriations, the Pentagon is set to have a temporary lapse in funding […]

-

Army

ArmyArmy Awards $1 Billion To RTX For LTAMDS Radar Production

The Army on January 29 awarded $1.03 billion to RTX [RTX] for continued production of the Lower Tier Air and Missile Defense Sensor (LTAMDS). The new contract modification covers production […]

-

Defense Watch

Defense WatchDefense Watch: DIB Days, DoD Biz Portal, Indian V-Bats, Drone Charging

Weapons and Tactics. U.S. Air Force’s Air Combat Command (ACC) recently hosted this year’s Weapons and Tactics Conference (WEPTAC) at Nellis AFB, Nev., to test out airmen-developed concepts and systems […]

-

Business/Financial

Business/FinancialConstruction Of Anduril’s Arsenal-1 Facilities Underway; Production Of Fury Ahead

Anduril Industries last Thursday said construction of the first building at its future Arsenal-1 manufacturing facility is “well underway” and that production of its YFQ-44A Fury collaborative combat aircraft (CCA) […]

-

Space

SpaceVarda Space Capsule Launched In November Successfully Returns To Earth

A satellite equipped with a Navy payload that was launched in November 2025 successfully returned to Earth in January, marking the first time Varda Space Industries has used its own […]